Adempiere3.1.2/en/ManPageW TaxDeclaration olh

Window: Tax Declaration

Description : Define the declaration to the tax authorities

Help : The tax declaration allows you to create supporting information and reconcile the documents with the accounting

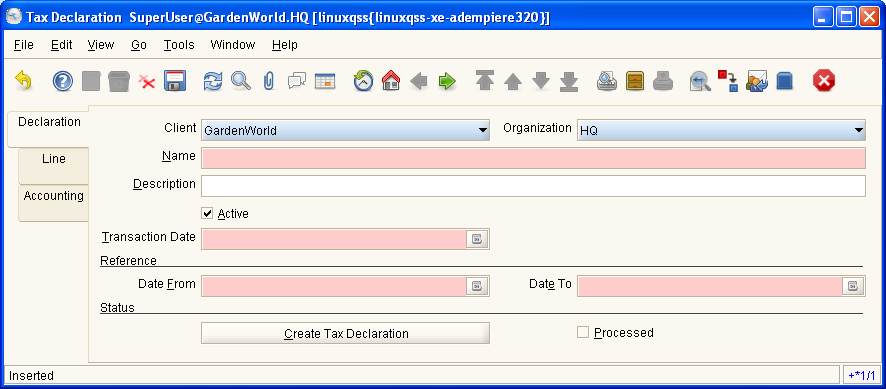

Tab: Declaration

Description : Define the declaration to the tax authorities

Help : The tax declaration allows you to create supporting information and reconcile the documents with the accounting

Table Name : C_TaxDeclaration

| Name | Description | Help | Technical Data |

|---|---|---|---|

| Client | Client/Tenant for this installation. | A Client is a company or a legal entity. You cannot share data between Clients. Tenant is a synonym for Client. | AD_Client_ID

NUMBER(10) TableDir |

| Organization | Organizational entity within client | An organization is a unit of your client or legal entity - examples are store, department. You can share data between organizations. | AD_Org_ID

NUMBER(10) TableDir |

| Name | Alphanumeric identifier of the entity | The name of an entity (record) is used as an default search option in addition to the search key. The name is up to 60 characters in length. | Name

NVARCHAR2(60) String |

| Description | Optional short description of the record | A description is limited to 255 characters. | Description

NVARCHAR2(255) String |

| Active | The record is active in the system | There are two methods of making records unavailable in the system: One is to delete the record, the other is to de-activate the record. A de-activated record is not available for selection, but available for reports.

There are two reasons for de-activating and not deleting records: (1) The system requires the record for audit purposes. (2) The record is referenced by other records. E.g., you cannot delete a Business Partner, if there are invoices for this partner record existing. You de-activate the Business Partner and prevent that this record is used for future entries. |

IsActive

CHAR(1) YesNo |

| Transaction Date | Transaction Date | The Transaction Date indicates the date of the transaction. | DateTrx

DATE Date |

| Date From | Starting date for a range | The Date From indicates the starting date of a range. | DateFrom

DATE Date |

| Date To | End date of a date range | The Date To indicates the end date of a range (inclusive) | DateTo

DATE Date |

| Create Tax Declaration | Create Tax Declaration from Documents | Processing

CHAR(1) Button | |

| Processed | The document has been processed | The Processed checkbox indicates that a document has been processed. | Processed

CHAR(1) YesNo |

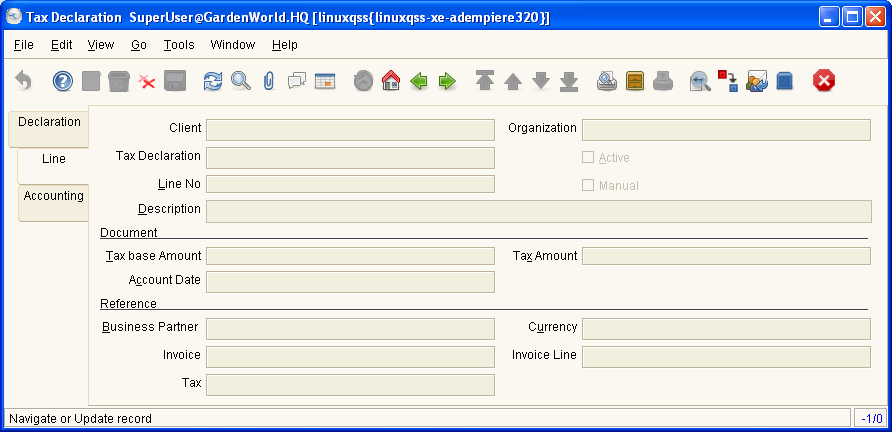

Tab: Line

Description : Tax Declaration Lines

Help : The lines are created by the create process. You can delete them if you do not want to include them in a particular declaration. You can create manual adjustment lines.

Table Name : C_TaxDeclarationLine

| Name | Description | Help | Technical Data |

|---|---|---|---|

| Client | Client/Tenant for this installation. | A Client is a company or a legal entity. You cannot share data between Clients. Tenant is a synonym for Client. | AD_Client_ID

NUMBER(10) TableDir |

| Organization | Organizational entity within client | An organization is a unit of your client or legal entity - examples are store, department. You can share data between organizations. | AD_Org_ID

NUMBER(10) TableDir |

| Tax Declaration | Define the declaration to the tax authorities | The tax declaration allows you to create supporting information and reconcile the documents with the accounting | C_TaxDeclaration_ID

NUMBER(10) TableDir |

| Active | The record is active in the system | There are two methods of making records unavailable in the system: One is to delete the record, the other is to de-activate the record. A de-activated record is not available for selection, but available for reports.

There are two reasons for de-activating and not deleting records: (1) The system requires the record for audit purposes. (2) The record is referenced by other records. E.g., you cannot delete a Business Partner, if there are invoices for this partner record existing. You de-activate the Business Partner and prevent that this record is used for future entries. |

IsActive

CHAR(1) YesNo |

| Line No | Unique line for this document | Indicates the unique line for a document. It will also control the display order of the lines within a document. | Line

NUMBER(10) Integer |

| Manual | This is a manual process | The Manual check box indicates if the process will done manually. | IsManual

CHAR(1) YesNo |

| Description | Optional short description of the record | A description is limited to 255 characters. | Description

NVARCHAR2(255) String |

| Tax base Amount | Base for calculating the tax amount | The Tax Base Amount indicates the base amount used for calculating the tax amount. | TaxBaseAmt

NUMBER Amount |

| Tax Amount | Tax Amount for a document | The Tax Amount displays the total tax amount for a document. | TaxAmt

NUMBER Amount |

| Account Date | Accounting Date | The Accounting Date indicates the date to be used on the General Ledger account entries generated from this document. It is also used for any currency conversion. | DateAcct

DATE Date |

| Business Partner | Identifies a Business Partner | A Business Partner is anyone with whom you transact. This can include Vendor, Customer, Employee or Salesperson | C_BPartner_ID

NUMBER(10) Search |

| Currency | The Currency for this record | Indicates the Currency to be used when processing or reporting on this record | C_Currency_ID

NUMBER(10) TableDir |

| Invoice | Invoice Identifier | The Invoice Document. | C_Invoice_ID

NUMBER(10) Search |

| Invoice Line | Invoice Detail Line | The Invoice Line uniquely identifies a single line of an Invoice. | C_InvoiceLine_ID

NUMBER(10) Search |

| Tax | Tax identifier | The Tax indicates the type of tax used in document line. | C_Tax_ID

NUMBER(10) TableDir |

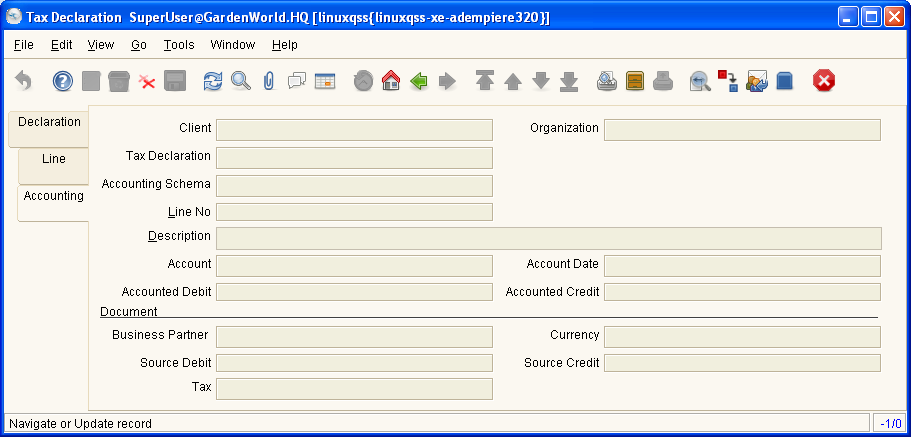

Tab: Accounting

Description : Tax Accounting Reconciliation

Help : Displays all accounting related information for reconcilation with documents. It includes all revenue/expense and tax entries as a base for detail reporting

Table Name : C_TaxDeclarationAcct

| Name | Description | Help | Technical Data |

|---|---|---|---|

| Client | Client/Tenant for this installation. | A Client is a company or a legal entity. You cannot share data between Clients. Tenant is a synonym for Client. | AD_Client_ID

NUMBER(10) TableDir |

| Organization | Organizational entity within client | An organization is a unit of your client or legal entity - examples are store, department. You can share data between organizations. | AD_Org_ID

NUMBER(10) TableDir |

| Tax Declaration | Define the declaration to the tax authorities | The tax declaration allows you to create supporting information and reconcile the documents with the accounting | C_TaxDeclaration_ID

NUMBER(10) TableDir |

| Accounting Schema | Rules for accounting | An Accounting Schema defines the rules used in accounting such as costing method, currency and calendar | C_AcctSchema_ID

NUMBER(10) TableDir |

| Line No | Unique line for this document | Indicates the unique line for a document. It will also control the display order of the lines within a document. | Line

NUMBER(10) Integer |

| Description | Optional short description of the record | A description is limited to 255 characters. | Description

NVARCHAR2(255) String |