ManPageW PaymentTerm

Enjoy it, and help to fill it! But please, always respecting copyright.

Please write your contributions under the Contributions Section

Contents

- 1 Window: Payment Term

- 2 Contributions

- 2.1 30 days EOM

- 2.2 Window : Payment Term (optional)

- 2.2.1 Tab : Payment Term (optional)

- 2.2.1.1 Field: Client (required)

- 2.2.1.2 Field: Organization (required)

- 2.2.1.3 Field: Search Key (optional)

- 2.2.1.4 Field: Name (required)

- 2.2.1.5 Field: Description (optional)

- 2.2.1.6 Field: Active (optional)

- 2.2.1.7 Field: Default (optional)

- 2.2.1.8 Field: Fixed due date (optional)

- 2.2.1.9 Field: After Delivery (optional)

- 2.2.1.10 Field: Next Business Day (optional)

- 2.2.1.11 Field: Fix month day (required)

- 2.2.1.12 Field: Fix month cutoff (required)

- 2.2.1.13 Field: Fix month offset (optional)

- 2.2.1.14 Field: Net Days (optional)

- 2.2.1.15 Field: Net Day (optional)

- 2.2.1.16 Field: Discount Days (optional)

- 2.2.1.17 Field: Discount % (optional)

- 2.2.1.18 Field: Discount Days 2 (optional)

- 2.2.1.19 Field: Discount 2 % (optional)

- 2.2.1.20 Field: Grace Days (optional)

- 2.2.1.21 Field: Document Note (optional)

- 2.2.1.22 Field: Validate (optional)

- 2.2.1.23 Field: Valid (optional)

- 2.2.2 Tab : Translation (optional)

- 2.2.3 Tab : Schedule (optional)

- 2.2.3.1 Field: Client (required)

- 2.2.3.2 Field: Organization (required)

- 2.2.3.3 Field: Payment Term (required)

- 2.2.3.4 Field: Active (optional)

- 2.2.3.5 Field: Valid (required)

- 2.2.3.6 Field: Percentage (optional)

- 2.2.3.7 Field: Net Days (optional)

- 2.2.3.8 Field: Discount Days (optional)

- 2.2.3.9 Field: Discount % (optional)

- 2.2.1 Tab : Payment Term (optional)

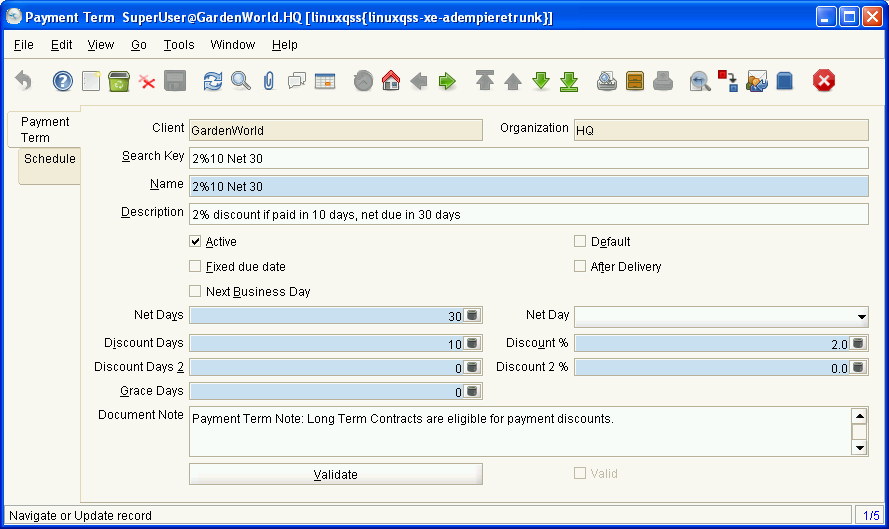

Window: Payment Term

Description : Maintain Payment Terms

Help : The Payment Terms Window defines the different payment terms that you offer your customers and that are offered to you by your vendors. Each invoice must contain a Payment Term. On the standard invoice, the Name and the Document Note of the Payment Term is printed.

Tab: Payment Term

Description : Define Payment Terms

Help : The Payment Term Tab defines the different payments terms that you offer to your Business Partners when paying invoices and also those terms which your Vendors offer you for payment of your invoices. On the standard invoice, the Name and the Document Note of the Payment Term is printed.

Table Name : C_PaymentTerm

Fields

| Name | Description | Help | Technical Data |

|---|---|---|---|

| Client | Client/Tenant for this installation. | A Client is a company or a legal entity. You cannot share data between Clients. Tenant is a synonym for Client. | AD_Client_ID

NUMBER(10) TableDir |

| Organization | Organizational entity within client | An organization is a unit of your client or legal entity - examples are store, department. You can share data between organizations. | AD_Org_ID

NUMBER(10) TableDir |

| Search Key | Search key for the record in the format required - must be unique | A search key allows you a fast method of finding a particular record.

If you leave the search key empty, the system automatically creates a numeric number. The document sequence used for this fallback number is defined in the "Maintain Sequence" window with the name "DocumentNo_<TableName>", where TableName is the actual name of the table (e.g. C_Order). |

Value

NVARCHAR2(40) String |

| Name | Alphanumeric identifier of the entity | The name of an entity (record) is used as an default search option in addition to the search key. The name is up to 60 characters in length. | Name

NVARCHAR2(60) String |

| Description | Optional short description of the record | A description is limited to 255 characters. | Description

NVARCHAR2(255) String |

| Active | The record is active in the system | There are two methods of making records unavailable in the system: One is to delete the record, the other is to de-activate the record. A de-activated record is not available for selection, but available for reports.

There are two reasons for de-activating and not deleting records: (1) The system requires the record for audit purposes. (2) The record is referenced by other records. E.g., you cannot delete a Business Partner, if there are invoices for this partner record existing. You de-activate the Business Partner and prevent that this record is used for future entries. |

IsActive

CHAR(1) YesNo |

| Default | Default value | The Default Checkbox indicates if this record will be used as a default value. | IsDefault

CHAR(1) YesNo |

| Fixed due date | Payment is due on a fixed date | The Fixed Due Date checkbox indicates if invoices using this payment tern will be due on a fixed day of the month. | IsDueFixed

CHAR(1) YesNo |

| After Delivery | Due after delivery rather than after invoicing | The After Delivery checkbox indicates that payment is due after delivery as opposed to after invoicing. | AfterDelivery

CHAR(1) YesNo |

| Next Business Day | Payment due on the next business day | The Next Business Day checkbox indicates that payment is due on the next business day after invoice or delivery. | IsNextBusinessDay

CHAR(1) YesNo |

| Fix month day | Day of the month of the due date | The Fix Month Day indicates the day of the month that invoices are due. This field only displays if the fixed due date checkbox is selected. | FixMonthDay

NUMBER(10) Integer |

| Fix month cutoff | Last day to include for next due date | The Fix Month Cutoff indicates the last day invoices can have to be included in the current due date. This field only displays when the fixed due date checkbox has been selected. | FixMonthCutoff

NUMBER(10) Integer |

| Fix month offset | Number of months (0=same, 1=following) | The Fixed Month Offset indicates the number of months from the current month to indicate an invoice is due. A 0 indicates the same month, a 1 the following month. This field will only display if the fixed due date checkbox is selected. | FixMonthOffset

NUMBER(10) Integer |

| Net Days | Net Days in which payment is due | Indicates the number of days after invoice date that payment is due. | NetDays

NUMBER(10) Integer |

| Net Day | Day when payment is due net | When defined, overwrites the number of net days with the relative number of days to the the day defined. | NetDay

CHAR(1) List |

| Discount Days | Number of days from invoice date to be eligible for discount | The Discount Days indicates the number of days that payment must be received in to be eligible for the stated discount. | DiscountDays

NUMBER(10) Integer |

| Discount % | Discount in percent | The Discount indicates the discount applied or taken as a percentage. | Discount

NUMBER Number |

| Discount Days 2 | Number of days from invoice date to be eligible for discount | The Discount Days indicates the number of days that payment must be received in to be eligible for the stated discount. | DiscountDays2

NUMBER(10) Integer |

| Discount 2 % | Discount in percent | The Discount indicates the discount applied or taken as a percentage. | Discount2

NUMBER Number |

| Grace Days | Days after due date to send first dunning letter | The Grace Days indicates the number of days after the due date to send the first dunning letter. This field displays only if the send dunning letters checkbox has been selected. | GraceDays

NUMBER(10) Integer |

| Document Note | Additional information for a Document | The Document Note is used for recording any additional information regarding this product. | DocumentNote

NVARCHAR2(2000) Text |

| Validate | Validate Payment Terms and Schedule | Processing

CHAR(1) Button | |

| Valid | Element is valid | The element passed the validation check | IsValid

CHAR(1) YesNo |

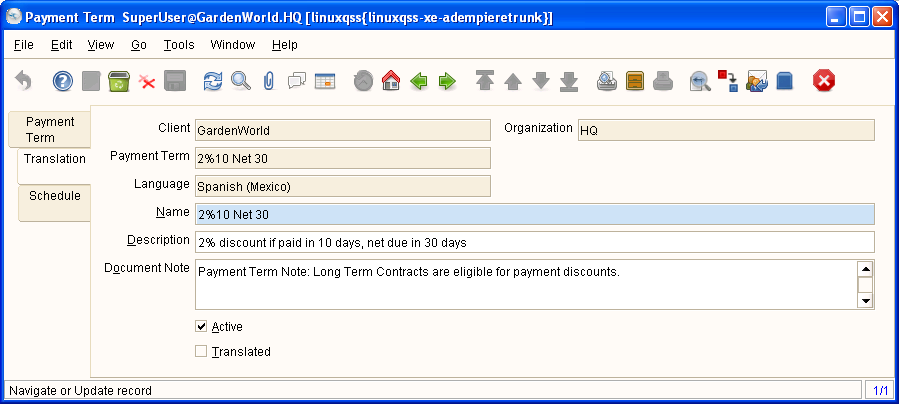

Tab: Translation

Description :

Help :

Table Name : C_PaymentTerm_Trl

Fields

| Name | Description | Help | Technical Data |

|---|---|---|---|

| Client | Client/Tenant for this installation. | A Client is a company or a legal entity. You cannot share data between Clients. Tenant is a synonym for Client. | AD_Client_ID

NUMBER(10) TableDir |

| Organization | Organizational entity within client | An organization is a unit of your client or legal entity - examples are store, department. You can share data between organizations. | AD_Org_ID

NUMBER(10) TableDir |

| Payment Term | The terms of Payment (timing, discount) | Payment Terms identify the method and timing of payment. | C_PaymentTerm_ID

NUMBER(10) TableDir |

| Language | Language for this entity | The Language identifies the language to use for display and formatting | AD_Language

VARCHAR2 Table |

| Name | Alphanumeric identifier of the entity | The name of an entity (record) is used as an default search option in addition to the search key. The name is up to 60 characters in length. | Name

NVARCHAR2(60) String |

| Description | Optional short description of the record | A description is limited to 255 characters. | Description

NVARCHAR2(255) String |

| Document Note | Additional information for a Document | The Document Note is used for recording any additional information regarding this product. | DocumentNote

NVARCHAR2(2000) Text |

| Active | The record is active in the system | There are two methods of making records unavailable in the system: One is to delete the record, the other is to de-activate the record. A de-activated record is not available for selection, but available for reports.

There are two reasons for de-activating and not deleting records: (1) The system requires the record for audit purposes. (2) The record is referenced by other records. E.g., you cannot delete a Business Partner, if there are invoices for this partner record existing. You de-activate the Business Partner and prevent that this record is used for future entries. |

IsActive

CHAR(1) YesNo |

| Translated | This column is translated | The Translated checkbox indicates if this column is translated. | IsTranslated

CHAR(1) YesNo |

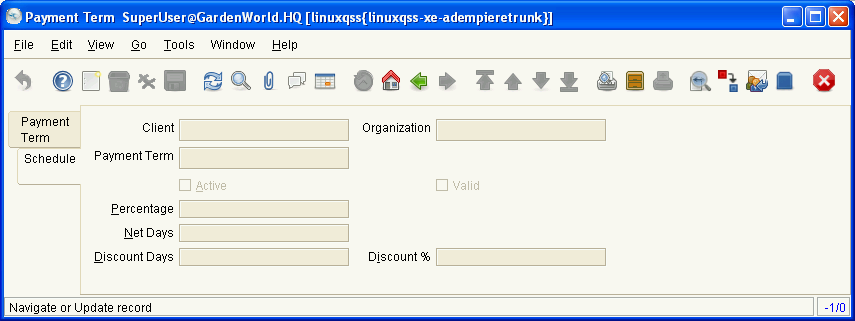

Tab: Schedule

Description : Payment Schedule

Help :

Table Name : C_PaySchedule

Fields

| Name | Description | Help | Technical Data |

|---|---|---|---|

| Client | Client/Tenant for this installation. | A Client is a company or a legal entity. You cannot share data between Clients. Tenant is a synonym for Client. | AD_Client_ID

NUMBER(10) TableDir |

| Organization | Organizational entity within client | An organization is a unit of your client or legal entity - examples are store, department. You can share data between organizations. | AD_Org_ID

NUMBER(10) TableDir |

| Payment Term | The terms of Payment (timing, discount) | Payment Terms identify the method and timing of payment. | C_PaymentTerm_ID

NUMBER(10) TableDir |

| Active | The record is active in the system | There are two methods of making records unavailable in the system: One is to delete the record, the other is to de-activate the record. A de-activated record is not available for selection, but available for reports.

There are two reasons for de-activating and not deleting records: (1) The system requires the record for audit purposes. (2) The record is referenced by other records. E.g., you cannot delete a Business Partner, if there are invoices for this partner record existing. You de-activate the Business Partner and prevent that this record is used for future entries. |

IsActive

CHAR(1) YesNo |

| Valid | Element is valid | The element passed the validation check | IsValid

CHAR(1) YesNo |

| Percentage | Percent of the entire amount | Percentage of an amount (up to 100) | Percentage

NUMBER Number |

| Net Days | Net Days in which payment is due | Indicates the number of days after invoice date that payment is due. | NetDays

NUMBER(10) Integer |

| Discount Days | Number of days from invoice date to be eligible for discount | The Discount Days indicates the number of days that payment must be received in to be eligible for the stated discount. | DiscountDays

NUMBER(10) Integer |

| Discount % | Discount in percent | The Discount indicates the discount applied or taken as a percentage. | Discount

NUMBER Number |

Contributions

You will find further information here in the Contributions section, as the above sections are automatically generated. Therefore, any changes there would be lost.

The information below should be only additional information to supplement the above. If you find duplications to the above then please edit or raise a note in the Adempiere forum in Sourceforge.

To understand the meaning of optional & required as used below, see Optional & Required Definitions for an explanation.

30 days EOM

Many businesses use the traditional payment term of 30 days from the end of the month in which an invoice is dated, as it is convenient for systems that operate on a monthly aging cycle. This behaviour can be emulated in Adempiere using a payment term with the following settings:

- Fixed due date: yes

- Fix month day: 30

- Fix month cutoff: 31

- Fix month offset: 1

Window : Payment Term (optional)

Path: Menu > Partner Relations > Business Partner Rules > Payment Term

Here you define the different payment terms that will apply to a business partner.

Tab : Payment Term (optional)

Field: Client (required)

See Basic & Common Field Definitions - Client

Field: Organization (required)

See Basic & Common Field Definitions - Organization

Field: Search Key (optional)

See Basic & Common Field Definitions - Search Key

Field: Name (required)

See Basic & Common Field Definitions - Name

Field: Description (optional)

See Basic & Common Field Definitions - Description

Field: Active (optional)

See Basic & Common Field Definitions - Active

Field: Default (optional)

See Basic & Common Field Definitions - Default

Field: Fixed due date (optional)

When selected the following fields appear, Fix month day, Fix month cutoff, & Fix month offset. While Net Days, & Net Day are removed.

Field: After Delivery (optional)

No further notes.

Field: Next Business Day (optional)

No further notes.

Field: Fix month day (required)

This field only appears if Fixed due date is ticked.

A value between 1 and 31.

Field: Fix month cutoff (required)

This field only appears if Fixed due date is ticked.

A value between 1 and 31.

Field: Fix month offset (optional)

This field only appears if Fixed due date is ticked.

Field: Net Days (optional)

This field only appears if Fixed due date is not ticked.

Field: Net Day (optional)

This field only appears if Fixed due date is not ticked.

Field: Discount Days (optional)

No further information.

Field: Discount % (optional)

No further information.

Field: Discount Days 2 (optional)

No further information.

Field: Discount 2 % (optional)

No further information.

Field: Grace Days (optional)

No further information.

Field: Document Note (optional)

No further information.

Field: Validate (optional)

No further information.

Field: Valid (optional)

No further information.

Tab : Translation (optional)

Not available in version 3.4.0s.

Tab : Schedule (optional)

The tab allows you to set up a schedule for the defined payment term. That is, a schedule whereby the Business Partner, client, or organisation is able to make payments over a period of time. For example, pay 50% today and the remainder in 60 days.

If you elect to create a schedule you must create at least 2 records. Otherwise, the Payment Term will not validate successfully. Even if the first record is 100%, the second record must be created but with 0% in the percentage field..

Field: Client (required)

See Basic & Common Field Definitions - Client

Field: Organization (required)

See Basic & Common Field Definitions - Organization

Field: Payment Term (required)

This is the payment term that was selected in the Payment Term tab.

Field: Active (optional)

See Basic & Common Field Definitions - Active

Field: Valid (required)

The field is greyed out and will be ticked when the record has been successfully validated on the Payment Term tab.

When the record/s are saved it will validate automatically. Therefore, if it is still not ticked, then there is a problem. You can then go to the Payment Term tab and click on the validate button to get further information.

Field: Percentage (optional)

No further information.

Field: Net Days (optional)

No further information.

Field: Discount Days (optional)

No further information.

Field: Discount % (optional)

No further information.